Fundamental and Tactical Factors Underpinning Impending Bitcoin Price Rally

Uncover the essential fundamental and tactical elements fueling the expected Bitcoin price increase. Understand market dynamics, investor perspectives, and strategic shifts set to influence the cryptocurrency domain.

There is perhaps no hotter topic on the internet right now than discussing the future prospects of Bitcoin and other major crypto-assets, given the clear signs that “something is happening” in the crypto-market. Is what we are seeing now really a “crypto spring” and the beginning of a new full-fledged cycle, or is it just nothing more than a temporary correction from oversold status? And if we are dealing with a new cycle of long-term growth, how can we evaluate its potential in a situation where crypto analysts' assessments differ so much from each other?

Cryptowinter Transforming into Crypto-renaissance

Cryptowinter, the bearish phase that sent the cryptocurrency markets into a prolonged slump, and, then, stagnation, has finally come to an end. Several factors have contributed to this turnaround, bringing hope and optimism back into the crypto space.

Firstly, it was the maturation of the industry that played a significant role in ending cryptowinter. Over the past year, we have seen the emergence of institutional investors stepping into the market of Satoshi Nakamoto's creation while injecting much-needed liquidity and stability. Their presence has helped restore confidence among retail investors and paved the way for further adoption.

In 2023, institutional investors made a groundbreaking return to the spotlight by entering the crypto market. Numerous key factors contributed to this significant shift in their investment priorities and strategies. First and foremost, institutional investors were drawn to the immense growth potential and high returns that cryptocurrencies offered in the wake of bids for spot Bitcoin and spot Ethereum exchange-traded funds, ETFs for short, while the U.S. Securities and Exchanges Commission, SEC, started demonstrating certain tiredness of so many crypto-related lawsuits, including the multiyear one against the Ripple Labs, consuming the agency’s time and efforts, but apparently leading to nowhere.

Furthermore, the increasing acceptance and regulation of cryptocurrencies by governments and financial institutions lent credibility to this emerging asset class. With more and more countries acknowledging the legitimacy of cryptocurrencies, institutional investors felt more confident in allocating their funds to this market.

Another crucial factor that pushed institutional investors into the crypto market was the diversification aspect. Many traditional investment portfolios lacked exposure to digital assets, and by entering the crypto market, institutions aimed to diversify their portfolios and reduce high-covariance risks.

Ongoing Upgrades and System Improvements Serve as Catalysts of Wider Acceptance

Additionally, the advancements in blockchain technology, particularly in areas such as security, scalability, and efficiency, provided a solid foundation for institutional investors to return their trust in the crypto and adopt Bitcoin. The constantly upgradable blockchain technology including several new PoS protocol improvements carried out by Ethereum and, lately, Solana, and, then, the introduction of a new universal protocol of Bitcoin known as Ordinals, offered higher transparency, velocity, applicability, and traceability, addressing some of the concerns that had previously deterred them from entering the market.

Institutional and Technological Factors

All these factors combined created an irreversible opportunity for institutional investors in 2023, as they recognized the potential of cryptocurrencies to reshape the financial landscape and generate substantial returns.

Additionally, regulatory clarity has started to take shape, creating a more favorable environment for cryptocurrencies. Governments around the world are beginning to develop comprehensive frameworks that facilitate innovation while protecting consumers and investors. This increased certainty has attracted traditional financial institutions, signaling mainstream acceptance of digital assets.

Furthermore, technological advancements, such as the partially mentioned scalability solutions implemented by various blockchain projects, have addressed some of the limitations that plagued cryptocurrencies during the winter.

As a result, a combination of institutional involvement, regulatory improvements, an increase in the bitcoin miners count, and technological advancements have brought an end to Cryptowinter. As the crypto market begins to regain momentum, we can anticipate renewed enthusiasm and a brighter future for cryptocurrencies.

Wide Array of Bitcoin ETF Launches Add Even More Fuel to Growth

Bitcoin's growth drivers are now particularly important because retrospectively it has been exactly Bitcoin whose strength of the initial growth phase laid the ground for sequential broad rallies. Speaking about current events, they will include the upcoming sound ETFs and, of course, next year’s halving. But now it would be more correct to assess the capacity of the initial growth momentum associated with the upcoming “parade of ETF launches”, which will lead to broad purchases of the main cryptocurrency by institutional investors. But how to evaluate this potential?

Grayscale to Lead Upcoming Changes

To date, only one exchange-traded fund – Grayscale Bitcoin Trust (GBTC) — is copying Bitcoin's dynamics, which is not really focused on Bitcoin, but on its derivatives – futures traded on the Chicago Board of Futures and Options Trading (CBOT). As many know, on July 14 SEC accepted applications from BlackRock, VanEck, Fidelity Investments, Invesco, and WisdomTree, specifically for spot Bitcoin exchange-traded funds, but after the expiration of the statutory cooling-off period, it decided to postpone its vital decision “until better times,” still reluctant to say a definite “no”.

In June, Grayscale sued the regulator for refusing to convert its flagship GBTC trust into a Bitcoin ETF. The company submitted an application to the SEC to convert the investment product in October 2021.

According to a number of trustworthy crypto analytics portals, including Cointelegraph and Galaxy Digital, the spot Bitcoin exchange-traded funds (ETFs) are capable of attracting at least $14.4 billion in the first year upon their mass launch.

Given that Bitcoin's market capitalization currently stands at about $674 billion, the most conservative estimate of the price effect from the net influx of fund purchases alone would be about 2.3% by the end of this year. Next year, by all indications, this should translate into a sustained upward price cycle, as in addition to the effect of fund inflows – already amounting to 4% of Bitcoin's current capitalization – the expectation of the much-talked-about halving will come into play, which has a “rally igniting power” for Bitcoin's price of tens of percent.

ETF Approval Brings Opportunities

Indeed, speaking of the current “run-up” phase, ETFs should become a more favorable investment tool for mainstream investors compared to the mass-market crypto alternatives currently on offer – such as trusts and futures, which have a market valued at $21 billion. The latest developments could see inflows increase by $27 billion by the second year (i.e., 2024) and $39 billion by the third (2025).

Here are more precise numbers: “The U.S. wealth management industry is likely to be the most accessible and direct market that will receive the largest net inflows of funds from an approved Bitcoin ETF. As of October 2023, total assets under management by broker-dealers ($27 trillion), banks ($11 trillion), and REITs ($9 trillion) totaled $48.3 trillion.” Of course, we're not even talking about half of these gigantic inflows with respect to their exposure to Bitcoin or even the entire crypto sector, and yet, the potential of new ETF-funding-related opportunities to buy Bitcoin for either person or group is mind-boggling!

Bitcoin has also become attractive for financial institutions that do not directly invest in crypto-assets. Some of them have entered into agreements on custody (custodial services) of digital assets, and they advertise them in every possible way as an alternative store of value to gold.

On the other hand, Galaxy believes that its estimates regarding access, exposure, and allocation are still conservative, so capital inflows could also be higher than expected. Inflows from ETF funds, market expectations in the context of Bitcoin's impending halving, and the possibility of interest rates peaking in the short term all point to the fact that 2024 could be a truly epochal year for Bitcoin.

Finally, the SEC Looks Increasingly Discouraged from its Legal Battle against Cryptos

According to CoinDesk, SEC Chairman Gary Gensler has so far routinely refused to disclose any plans for the agency to approve spot Bitcoin ETFs. His latest comments on the matter appeared at a securities enforcement forum held in Washington, D.C. on October 25. He said he would “let the deals evolve” and would not prejudge the situation until the SEC staff makes recommendations to the committee, which is known to have five members. Gensler was evasive when asked for any comment if and when this landmark issue is being considered to come into effect.

Gary Gensler gave a speech on SEC enforcement at the event that was critical of the crypto industry, and he reiterated that the industry is “rife with inappropriate (low) ethical standards (AKA “code of conduct”).” “The crypto sector is rife with scammers, and con artists, we see tons of bankruptcies and examples of money laundering”.

Gensler also declined to comment on other legal cases brought by his office against cryptocurrency companies. He said: “I will debate every case about bitcoin transactions and crypto offerings, and those arguments will be presented to lawyers.”

Now that the U.S. Federal Reserve is struggling with a $33 trillion “death spiral” of U.S. government debt, some institutional analysts warn that the Fed will be forced to restart its “money printer,” which could push the dollar into further losing its buying power thereby triggering a new cycle of Bitcoin price rally, which this time may coincide with one of gold.

The Outlook

To sum up, there are a good half a dozen solid factors in favor of growth, which are counterweighted only by a strengthening dollar buoyed by the continuing growth of U.S. Treasury bond yields, which make dollar investments more and more attractive, although the U.S. budget essentially pays for this “party”.

The latest U.S. macro statistics also speak in favor of the continuation of interest rate hikes by the U.S. central bank, the Fed. According to the latest data, inflation in the U.S. exceeded expectations in September: according to the latest data from the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose by 3.7% year-on-year. Although core inflation fell slightly from 4.3% to 4.1%, market experts anticipate that the U.S. Federal Reserve may once again raise its key rate, given the ongoing sticky inflationary trend.

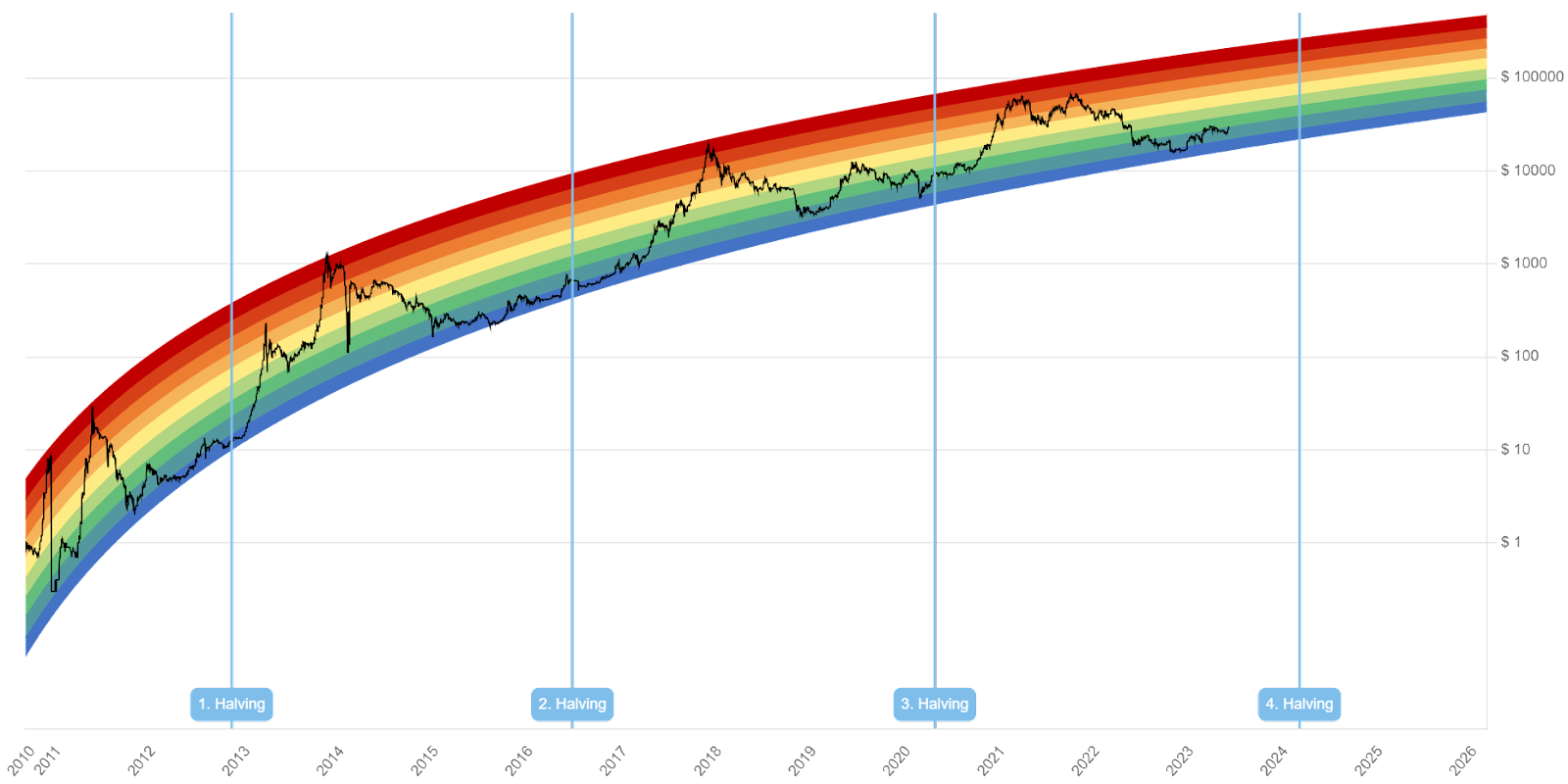

As we already mentioned above, one of the most obvious triggers for a Bitcoin rally should be the expected 2024 halving, scheduled for April 2024. Halving implies a deflationary trend in the Bitcoin protocol and gives it an additional time head start until the moment when 21,000,000 of the total number of BTC will be minted and the creation of new BTC will stop, which in itself will serve as a very powerful catalyst for the price rally of the main crypto-asset.

Upcoming Halving

Many crypto experts consider Bitcoin's halving as a very important event that strengthens the technology news agenda that is helping the world's largest digital currency by market capitalization to catch up while dispelling the crypto winter “blues”.

The bottom line is that astute private and institutional crypto investors feel the need to monitor Bitcoin activities daily, but not everyone realizes how to participate in a new upward price momentum apart from buying and holding BTC in their wallets. The problem is that by the time we enter 2024, it appears that we will be surviving the global economic recession of varying degrees of depth. That said, political analysts are talking about the formation of more and more signs and political hints that speak in favor of a Republican president in the White House for the next presidential term, and the Bitcoin endorsement will undoubtedly not only be an interesting event in the midst of the U.S. presidential election campaign, but it is also highly likely to make presidential candidates willing to express their attitudes towards the crypto industry as a whole.

The Future

The Fed may be forced to suddenly shift to a dovish stance in the event of a U.S. recession because of the U.S. central bank's larger-than-usual lag in deciding on a new round of interest rate hikes designed to curb inflation. In fact, this issue was not about to recede after a surge in the dollar money supply in 2020 and 2021 triggered by the U.S. government's efforts to compensate Americans for their income shortfalls during the COVID-19 epidemic rampage.

For their part, commodities analysts point to the emerging signs of a prolonged rise in oil prices following the outbreak of war between Israel and the Palestinian group Hamas, as well as an increase in labor strikes this year and meteorological problems that threaten commodity prices due to the El Niño weather phenomenon.

Meanwhile, according to Glassnode, long-term investors are accumulating more and more Bitcoins, leading to a tilt of supply/demand balance towards the latter. Bitcoin was created peer to peer in mind and only 21 million Bitcoin in total. Long-term investors, or wallet addresses with a holding history of at least 155 days, have accumulated 50,000 BTC worth $1.35 billion in a single month, according to Hodler's position change metric.