What is Crypto Arbitrage Algorithm: Can It Be Profitable?

Discover whether or not the crypto arbitrage algorithm can be profitable for digital asset traders. Triangular arbitrage, spatial arbitrage, and other trades.

Today, let's dive into the world of crypto arbitrage, where eagle-eyed traders spot those tiny price differences across exchanges and swoop in for a profit. But wait, is it really that simple? Shall we unpack this?

What is arbitrage trading?

Arbitrage has been the darling of the financial world long before Satoshi Nakamoto introduced Bitcoin to us. But with the crypto market's notorious volatility, the allure of arbitrage opportunities has only grown stronger. Why? Cryptocurrencies are traded across numerous global exchanges, offering a buffet of price discrepancies for the keen-eyed trader.

Imagine this: Bitcoin is priced at $29,000 on Coinbase and $28,800 on Kraken. If you're quick on the draw, you could buy Bitcoin on Coinbase and sell it on Kraken, pocketing a neat $200. That's crypto arbitrage in action.

But why do these price differences even exist? Centralized exchanges, like Coinbase and Binance, rely on their order book system. The most recent price at which a trade occurs becomes the real-time price of that asset on the exchange. So, if someone buys Bitcoin for $30,000 on one exchange, that becomes the latest price there. But on another exchange, the last trade might have been at $29,900. Hence, the difference.

On the other hand, decentralized exchanges operate differently. They use "automated market makers" and depend on crypto arbitrage traders to keep prices consistent with other exchanges. Instead of an order book, they rely on liquidity pools. So, if you want to trade Ethereum (ETH) for Chainlink (LINK), you'd need to find an ETH/LINK liquidity pool. The prices of assets in these pools are maintained by a mathematical formula, ensuring a balance.

The Growing Landscape of Crypto Arbitrage

At the moment of writing, there are a staggering 427 DEX exchanges and 224 spot crypto exchanges listed on CoinMarketCap. And with 8,877 tokens and a market cap soaring past $1T, the opportunities for arbitrage are vast. Statista further confirms this growth, stating there are 9,321 cryptocurrencies worldwide as of August 2023. This is a phenomenal leap from just 66 in 2013.

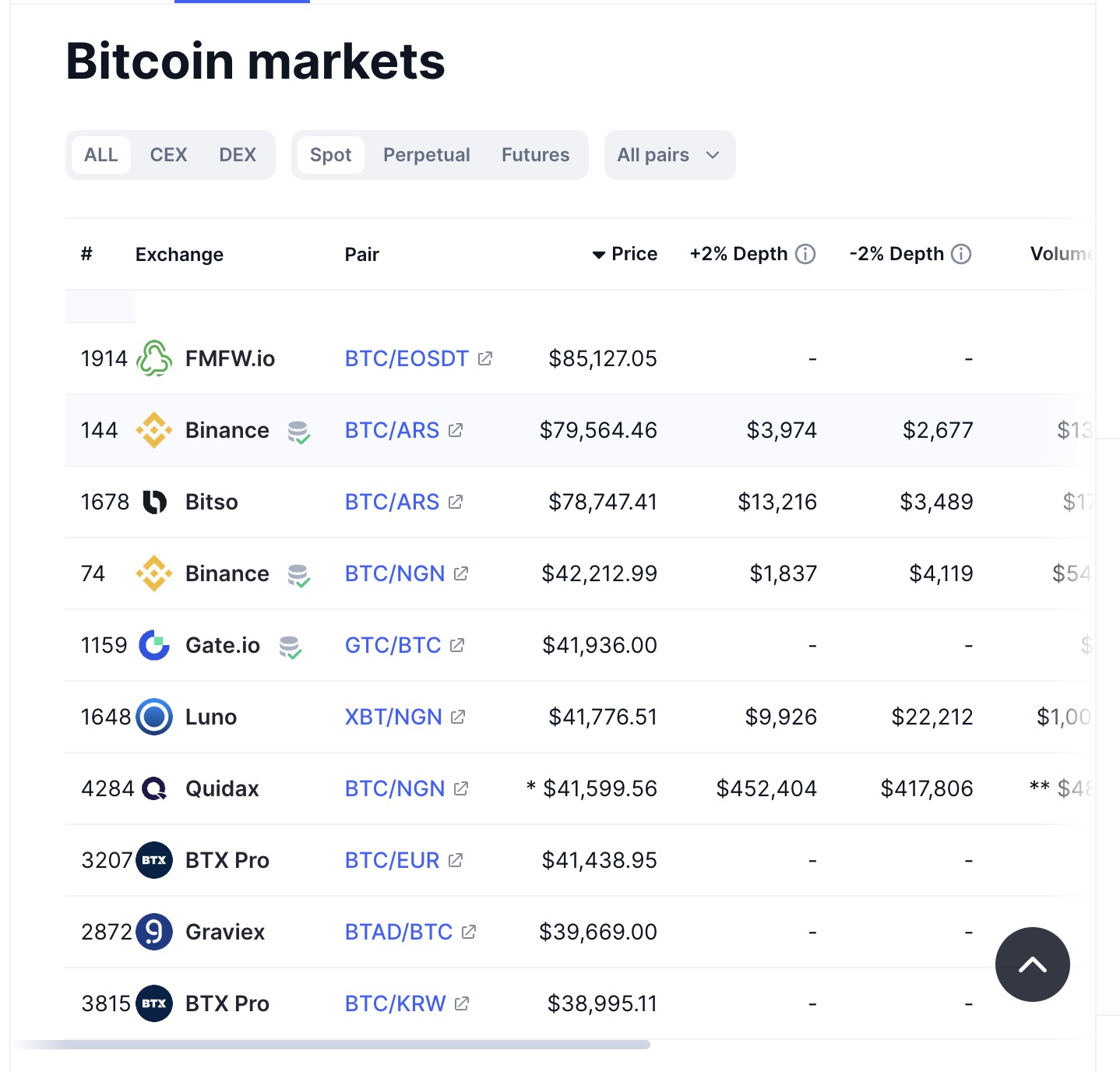

Now, if you still think crypto arbitrage is yet another get-rich-quick scheme, let's take a real-world example to illustrate its potential. If you were to open the markets tab on Bitcoin analysis on CoinMarketCap, you'd notice that the BTC price in USD can vary significantly depending on the pair and exchange. Price discrepancies can even be found within one exchange. For instance, the BTC/EUR and BTC/KRW pairs might show different prices. These discrepancies between different cryptocurrency exchanges highlight the potential profits that could have been made through arbitrage trading during those instances.

What Are the Different Types of Arbitrage for Cryptocurrencies?

In the ever-evolving world of crypto, arbitrage has become the buzzword for traders looking to exploit price discrepancies. But did you know there's more than one way to dance the arbitrage tango? Let's dive into the different types of crypto arbitrage and see which one might just be your next money-making move.

Triangular Arbitrage

Picture this: You're at a bustling crypto market. Bitcoin is trading for Ethereum, Ethereum for Litecoin, and Litecoin back for Bitcoin. But wait! There's a price discrepancy in this triangle. By trading these three cryptocurrencies in a specific sequence, you can pocket the difference. That's triangular arbitrage in a nutshell. It's all about exploiting price differences between three cryptocurrencies on the same exchange. But remember, it's a fast-paced dance, and you've got to keep up!

Latency arbitrage

Time is money, especially in the crypto market. Latency arbitrage is for the speed demons. It's about capitalizing on price discrepancies that exist for a mere fraction of a second between exchanges. Got a super-fast trading bot? This might be your jam.

Statistical Arbitrage

For those who love crunching numbers and analyzing patterns, statistical arbitrage is where it's at. It involves complex mathematical models and algorithms to predict future price movements. Buy low, sell high, and use those brainy algorithms to your advantage.

Bot Arbitrage

In a world where robots can vacuum our floors and make our coffee, why not let them handle our trading? Bot arbitrage involves using automated software to detect and exploit price discrepancies. Set it, forget it, and let your crypto arbitrage bot do the heavy lifting.

Spatial Arbitrage (Cross-Exchange Arbitrage)

Ever noticed how a candy bar might cost more at an airport than at your local store? That's spatial arbitrage in the real world. In the crypto realm, it's about buying a digital asset on one exchange and selling it on another where the price is higher. Simple, right? Spot a lower Bitcoin price on Binance and a higher one on Kraken? Buy on Binance, sell on Kraken, and cha-ching! Just remember to factor in those pesky trading fees.

Decentralized Exchange Arbitrage

Decentralized exchanges (DEXs) are the new kids on the block who are making waves. With no central authority, DEXs offer unique arbitrage opportunities. The best part? You're cutting out the middleman, which often means fewer fees and more profit. The downside: DEXs are usually less intuitive and offer limited trading tools. Although 0xDEFCAFE is determined to change the game. For instance, it offers both market and limit orders, something not all DEXs provide. There's also a nifty feature that lets you "snipe" launches in an automated way and cross-chain arbitrage between DEX. These little things can make a difference in the world of crypto trading.

Regulation and Crypto Arbitrage

In the ever-evolving world of cryptocurrencies, the term "crypto arbitrage" has been buzzing louder than a beehive. But with all the potential profits and the allure of quick gains, there's a shadowy figure lurking in the background: regulation. Now, it's essential to understand the regulatory landscape before diving headfirst into the crypto arbitrage pool.

Is Crypto Arbitrage Legal?

The short answer? It's complicated. Crypto arbitrage, in its essence, is the act of exploiting price differences between exchanges. It's like buying a vintage comic book at a garage sale for $5 and then selling it at a collector's convention for $50. Sounds simple, right? But when it comes to crypto, the waters get a tad murkier.

Different countries have different stances on crypto arbitrage. Some welcome it with open arms, while others give it the side-eye. And then there's the U.S., which, according to Guardian, has been keeping a close watch on major exchanges like Binance and Coinbase. The U.S. government's growing interest in these platforms is a clear sign that they're tightening the noose on crypto regulations. So, while crypto arbitrage isn't illegal per se, it's essential to be aware of the rules and regulations in your jurisdiction.

Can You Lose Money with Crypto Arbitrage?

Yes, there's potential for profit, but there's also potential for loss. And sometimes, it's a face-palm-worthy loss.

Factors like withdrawal fees, transaction fees, and the ever-volatile nature of cryptocurrencies can turn a seemingly profitable arbitrage opportunity into a financial nightmare. And remember, while tools like the crypto arbitrage bot can help, they're not infallible.

Moreover, with the increasing scrutiny from governments and regulatory bodies, one wrong move can land you in a soup hotter than molten lava. So, while platforms like 0xDEFCAFE offer advanced tools to aid in decentralized arbitrage, always remember the golden rule: Do your research and never invest more than you can afford to lose.

In the end, crypto arbitrage, like any other form of trading, comes with its risks and rewards. It's a thrilling roller coaster ride, but always ensure you've buckled up and are aware of the twists and turns ahead.

Crypto arbitrage trading risks

Diving into the world of crypto arbitrage can feel like you've stumbled upon a treasure map. But, like every treasure hunt, there are traps and pitfalls along the way. Before you begin, it's essential to understand the risks that lurk beneath the surface. Let's dive deep and uncover these hidden challenges.

Fees

When you're diving into the world of crypto arbitrage, it's essential to factor in the fees. Those pesky little critters can turn a profitable arbitrage opportunity into a break-even or even a loss. Centralized exchanges, like Kraken, usually have a tiered fee structure. For instance, if your trading volume for spot trading is between $0 - $50,000, the maker fee is 0.16% and the taker fee is 0.26%. And don't forget that withdrawing your crypto will cost you, too. For instance, the withdrawal commission for BTC on Kraken stands at 0.00005 BTC.

On the flip side, decentralized exchanges (e.g., the largest one - dYdX) have a different fee structure. The maker fee is 0.020%, and the taker fee is 0.050%. The silver lining? No withdrawal fees. So remember, high deposit and withdrawal fees can eat into your arbitrage profits, especially when moving funds between exchanges.

Timing

In the crypto world, timing isn't just everything; it's the only thing. Spotting a juicy arbitrage opportunity is one thing, but if you can't execute the trade in a split second, that golden opportunity can vanish. Some exchanges can be notoriously laggy, especially during peak trading hours. A delay of even a few seconds can be the difference between a profitable trade and a missed opportunity.

Transaction Delays And Slippage

Imagine spotting a perfect arbitrage opportunity, but by the time your transaction gets confirmed, the price has shifted, and you're left holding the bag. Transaction delays can be a real buzzkill. And then there's slippage – the difference between the expected price of a trade and the price at which the trade is executed. High volatility can lead to significant slippage. However, platforms like 0xDEFCAFE aim to minimize these risks by handling most of the trading backend, ensuring transactions are processed swiftly.

Lack of volume

Here's a scenario: you spot an arbitrage opportunity, but there's not enough trading volume to execute your trade without affecting the market price. This is especially common on smaller exchanges or with less popular trading pairs. Always ensure there's enough liquidity to complete your trade without significant price impact.

On an average day in October 2023, Coinbase, one of the largest centralized crypto exchanges, had a trading volume of $644,584,015. The largest DEX? A daily volume of $539,493,228. Now, compare that to the Nasdaq's daily trading volume, which soars past $200T. It's clear that while crypto trading volumes are impressive, they're still dwarfed by traditional financial markets and you should use the exchange and token to trade wisely.

Coins with the same ticker symbol

Some coins share the same ticker symbols across different exchanges. This can lead to confusion, and in the worst case, you might end up buying the wrong asset. Always double-check before executing a trade.

Pump-and-dump schemes

The crypto world is rife with pump-and-dump schemes. Manipulators artificially inflate the price of an asset (pump) and then sell off their holdings for a profit (dump), leaving unsuspecting traders in the lurch. According to Solidus Labs, over 212,000 scam tokens were created between September 2020 and January 1, 2022. Always be wary of too-good-to-be-true opportunities because even if your trade is short-term, sometimes your chances of selling a hyped digital asset might evaporate in a matter of seconds.

Security

While the thrill of crypto arbitrage can be intoxicating, never forget about security. Exchanges, both centralized and decentralized, can be targets for hackers. Always use trusted platforms, enable two-factor authentication, and never leave large amounts of funds on an exchange for an extended period.

Crypto regulations

The crypto landscape is ever-evolving, and so are the regulations surrounding it. Different countries have different stances on crypto arbitrage. Some embrace it, while others frown upon it. Always stay updated with the latest regulatory guidelines in your jurisdiction to avoid any legal complications and related risks.

How to Find the Best Crypto Arbitrage Opportunities?

Navigating the intricate world of crypto arbitrage can be compared to a strategic game of chess. It's about meticulously analyzing the board, predicting your opponent's moves, and seizing opportunities where the price of a crypto asset diverges across different exchanges. But with thousands of exchanges and countless digital assets, how does one pinpoint the winning opportunity? Here are some tips to keep in mind.

Check For Newly Listed Coins

The allure of making a profit through crypto arbitrage often draws traders to the dynamic world of newly listed coins. Here's the scenario: A fresh crypto asset is listed on Exchange A with an ask price of $100. Simultaneously, on Exchange B, the same asset displays a price of $110. This difference in price between two exchanges presents a tantalizing opportunity for arbitrageurs.

However, trading crypto, especially newly listed ones, isn't without its challenges. The volatility of these coins and the unpredictability of how the market will react can make buying and selling a high-stakes game. While the decentralized crypto landscape offers many cryptocurrency arbitrage opportunities, it's essential to approach cautiously.

Why? Because the crypto day can be unpredictable. One moment, you're capitalizing on the arbitrage opportunity, and the next, you might find yourself trying to transfer funds back to BTC or USDT to mitigate losses. The very nature of arbitrage is a trading strategy that requires swift decisions and actions. And with newly listed coins, the window to execute crypto arbitrage trades can be even narrower.

Moreover, while the price on one exchange might be tempting, there's always the risk associated with the exchange where the price seems too good. Pump-and-dump schemes, smart contracts vulnerabilities, or even discrepancies in the bid and ask prices can turn a promising trade sour.

Spotting Price Discrepancies: The Trader's Goldmine

Every trader knows the essence of the game: buy low, sell high. But in the vast ocean of cryptocurrency, how does one pinpoint where to buy and where to sell? The answer lies in diligently spotting price discrepancies across exchanges. With the fluctuating supply and demand of crypto assets, the price of crypto can vary significantly from one exchange to another. For instance, 1 btc might be priced differently on two platforms due to varying trading volumes or regional factors. Platforms and tools that offer real-time data on these price variations are invaluable for the keen-eyed crypto arbitrageur. By leveraging these tools, a trader would be poised to capitalize on these price gaps, going around the triangle of buy-sell-profit.

Deep Dive in Crypto News

Cryptocurrency isn't just about numbers; it's about staying updated and being part of the narrative. The crypto landscape evolves rapidly, and what's trending today might be obsolete tomorrow. Hence, it's crucial for any trader to keep their finger on the pulse of the crypto world. This isn't just about spotting immediate arbitrage opportunities but understanding the broader shifts in supply and demand across the market. Joining crypto forums, following thought leaders, and immersing oneself in the community can provide insights that might not be immediately apparent. Remember, in the world of crypto trading, knowledge isn't just power; it's profit. So, the next time you see a price on one exchange and a different one on another, ensure you're making an informed decision before you transfer and execute that trade.

Keep Up With Local Laws

You might be thinking, "What do local laws have to do with finding arbitrage opportunities?" Well, a lot. Some countries have restrictions on buying or selling certain cryptocurrencies. Being aware of these regulations can help you avoid potential pitfalls and focus on legitimate arbitrage opportunities.

Is Crypto Arbitrage Profitable?

The short answer is yes. But, like all things in life, it's not that simple. Arbitrage opportunities in crypto do exist, but they're fleeting. You need to be quick on the draw and even quicker on the execution.

Take this Reddit user, for instance, who made a cool $53 profit by selling ETH on Coinbase and buying it on Kraken. Or consider the story of notorious Sam Bankman Fried, who claimed to find a 50% price discrepancy while exploiting the Kimchi Premium when Bitcoin was priced higher in Korea than in the US.

But, for every success story, there are tales of missed opportunities and losses.

In the end, like all trading strategies, crypto arbitrage requires research, timing, and a bit of luck. But with the right approach, it can indeed be profitable. So, are you ready to dive in and capitalize on those price discrepancies across different crypto exchanges? The world of crypto arbitrage awaits!

Final Thoughts

For those looking to dive into this strategy, this beginner’s guide to crypto arbitrage emphasizes the importance of research. Understand the crypto asset prices across multiple exchanges, be aware of the arbitrage process, and always be ready to adapt your crypto arbitrage strategies. Remember, while the goal is to make a profit, limiting potential losses by spreading your funds on multiple exchanges and being vigilant about where you place your buy and sell orders is equally crucial.