DeFi vs. CeFi: The Battle for Financial Paradigm Domination

Dive into the DeFi vs. CeFi showdown for financial dominance. Explore the impact of trading bots on both decentralized and centralized finance realms.

In a statement commemorating Binance’s sixth anniversary on July 14, Binance CEO CZ predicted that DeFi will be more prominent than CeFi in the next six years. Essentially, Zhao said DeFi activity will continue to increase as more people use DeFi products and interact directly with blockchain networks. He added that DeFi will provide financial services to people who do not have access to traditional financial institutions such as banks.

Binance CEO CZ: “DeFi will be more prominent than CeFi in The Next Six Years”

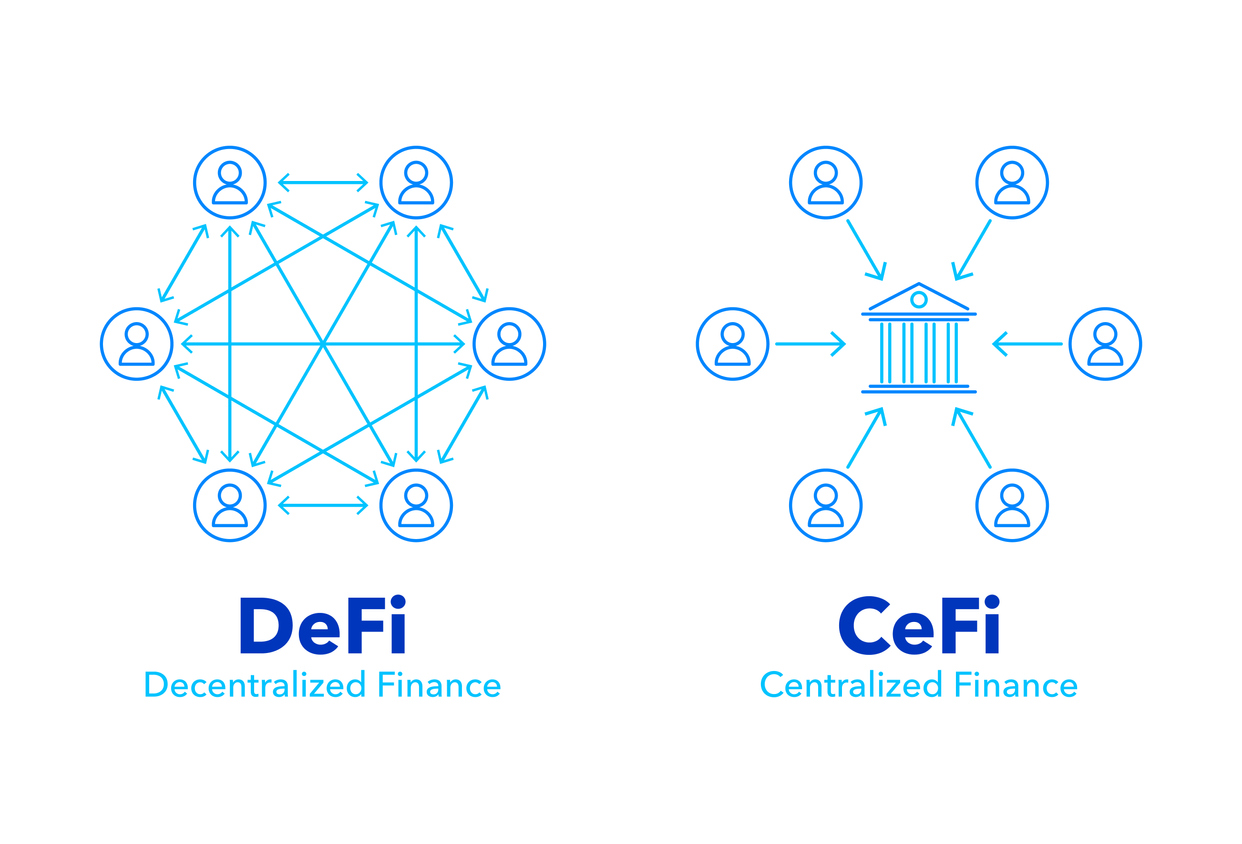

In short, CeFi refers to centralized finance, which provides financial services by centralized entities such as banks and other financial institutions. As we all know, DeFi stands for decentralized finance and refers to decentralized networks like DEX. The declared goal is to ensure the fairest possible exchange in cryptocurrency transactions. CeFi allows users to access various financial services such as borrowing money, trading cryptos, making purchases using crypto debit cards, and even earning rewards.

DeFi applications are required to be publicly verifiable on a blockchain, unlike CeFi.

Decentralized Finance (DeFi) provides customers with the ability to have direct control over their assets, whereas centralized finance (CeFi) is often sought after for its custody services in the realm of cryptocurrency.

What is Atomicity

The notion of atomicity in blockchain technology is crucial in that it enables transactions to be executed sequentially, meaning that they either succeed in their entirety or fail collectively. In the realm of DeFi, this function can be programmed directly into the system. In contrast, CeFi, in order to enforce atomicity typically relies on costly and controversial legal agreements.

DeFi projects are frequently established and supervised by unidentified groups, whereas CeFi usually offers users a lower level of anonymity.

The trading of cryptocurrency assets is subject to different mechanisms depending on the platform used. Centralized exchanges (CEXs) utilize limit order books to facilitate trades, whereas decentralized exchanges (DEXs) rely on automated market maker (AMM) protocols to determine asset prices. AMMs, in their turn, are highly compatible with various automated tools and protocols.

Advantages of Using DeFi Trading Bots

Thus, a DeFi trading bot is an automated software that executes trades on decentralized finance platforms. We at Def Café offer them as part of our services. These bots utilize predefined algorithms and strategies to identify current profitable trading opportunities in the DeFi space. With the rising popularity of decentralized finance, trading bots have become essential tools for investors looking to take advantage of the growing decentralized ecosystem. One of the primary benefits of using a DeFi trading bot is the ability to trade 24/7 without manual intervention. These bots can continuously monitor the market, analyze data, and execute trades based on predetermined parameters. This not only saves time but also eliminates the emotions that can often cloud judgment in trading. Moreover, DeFi trading bots can execute trades at lightning speed, leveraging instant access to liquidity and minimizing slippage.

Another advantage of using a DeFi trading bot is the ability to diversify trading strategies. These bots can be programmed to implement various strategies simultaneously, such as arbitrage, trend following, or market making. This diversification helps spread risk and increases the chances of capturing profitable opportunities across different DeFi platforms or tokens. In summary, DeFi trading bots are powerful tools that automate trading in the rapidly evolving decentralized finance space. They offer continuous monitoring, precise execution, and diversified strategies, enabling investors to maximize their trading efficiency and potentially generate higher returns.

In permissionless blockchains, users have the ability to freely circulate their ongoing transactions across a given peer-to-peer (P2P) network. This feature enables the terms of the crypto transactions to be determined by the market, leading to the availability of a variety of tactics used to enhance usefulness and cut on various costs of a given exchange’s ecosystem.

Other DeFi Advantages: Transaction Costs, Non-Interruption, Risk-Free Arbitrage

Transaction costs are an inescapable facet of DeFi transactions, while CeFi institutions can typically provide transaction services at no charge, but may impose various hidden commissions instead.

DeFi markets are accessible without interruption, operating around the clock every day of the week. In contrast, CeFi markets operate within specific working hours.

When it comes to privacy, DeFi offers a level of near-anonymity, whereas centralized exchanges that have AML policies in place divulge the identity of address owners to law enforcement agencies.

The act of arbitrage, whether it be on centralized or hybrid exchanges, inherently carries the risks of market price fluctuations. Conversely, arbitrage between two decentralized exchanges existing on the same blockchain can be characterized as risk-free.

Inflation transpires whenever the value of a currency diminishes as a result of a surge in its circulation. Fiat currency production is regulated by central banks, but in the DeFi realm, various cryptocurrencies are susceptible to changes (whether declared or undeclared) in their circulation. So far, it remains uncertain if cryptocurrencies can offer a resolution for the predicament of income inequality brought about by inflation.

CeFi also has certain advantages, such as fiat currency exchange flexibility and cross-chain services. They often serve as a bridge between the traditional finance and cryptocurrency worlds, providing familiar services in new areas.

Unique Advantages of DeFi

DeFi, on the other hand, brings some unique advantages. Its permissionless nature is one of its biggest advantages. Anyone can participate from anywhere without using a central authority. This democratizes financial services and is especially beneficial for the unbanked or underbanked.

DeFi also gives us complete control over our funds. P2P trading on DEX does not require users to entrust funds to a third party. This level of financial autonomy is a key selling point for many DeFi users.

However, DeFi faces challenges in cross-chain services and fiat currency exchange. Currently, the technical complexity of conducting atomic swaps across different blockchains imposes a major limitation. Additionally, most DeFi platforms are primarily cryptocurrency-centric and do not provide direct fiat access, which can be difficult for those new to the cryptocurrency world and may detract from their customary B2C experience.

CeFi Services and CeFi Companies

CeFi companies like Binance, Coinbase, and Kraken are among the most prominent examples in the industry. These companies offer exchange services that users can access by creating an account. The primary function of these platforms is to facilitate the transfer of tokens. However, these exchanges also provide additional services beyond this core function.

Despite the fact that funds are kept within the custody of an exchange, they are vulnerable to potential threats in the event of a security breach. DeFi protocols do more than just replicate basic CeFi services – they also enhance them to take advantage of the distinct properties of blockchain technology.

One example of this is the Automated Market Maker (AMM) system, which has replaced CeFi's traditional order-book structure in the DeFi space. The AMM smart contract functions by acquiring assets from liquidity providers, which allows traders to execute trades with the AMM contract instead of the liquidity providers themselves. This reduces the number of interactions with market makers compared to a CeFi order book, thus resulting in lower transaction costs.

DeFi, powered by blockchain technology, offers a decentralized and transparent alternative to CeFi. It eliminates intermediaries, allowing users to engage in peer-to-peer transactions, without the need for traditional banking institutions. The attractive aspect of DeFi lies in its promise of financial inclusivity, borderless transactions, and potential for higher returns through yield farming and decentralized lending protocols.

On the other hand, CeFi, characterized by centralized institutions like banks and financial intermediaries, brings stability and regulatory oversight to the financial system. CeFi platforms offer security, established reputations, and traditional financial products like loans and savings accounts. However, they also come with restrictions, high fees, delayed transactions, and limited accessibility.

The battle between DeFi and CeFi ultimately comes down to the clash between decentralization and centralization. Advocates of DeFi argue that it empowers individuals, promotes financial freedom, and reshapes the current financial landscape. They believe in the transformative potential of blockchain and decentralized governance models.

Final Words

Critics of DeFi emphasize the risks associated with its decentralized nature. They raise concerns about regulatory compliance, security vulnerabilities, and potential risks of fraud or smart contract failures. CeFi proponents argue that centralized systems provide necessary oversight, customer support, and established frameworks to ensure stability and minimize risk. Ultimately, the future of finance may lie in finding a balance between DeFi and CeFi. Both have unique strengths and weaknesses, and exploring avenues for collaboration could result in a more robust and inclusive financial ecosystem. The key lies in harnessing the benefits of decentralization while addressing the concerns around compliance, security, and user experience.

In conclusion, the battle between DeFi and CeFi represents a fundamental shift in the way financial systems operate in general. Perhaps, at the current stage of crypto industry development, CeFi remains more warranted and preferred by most new entrants. Their wariness about tapping into an enormously broad, but largely unexplored DeFi universe, is naturally explained by our rudimentary way of thinking, where publicly acknowledged benchmarks and behavioral patterns remain key to securing the trustworthiness and legitimacy of our value exchange domains. Gradual shift from CeFi to DeFi platforms is pre-determined simply because it will give us unlimited freedom of what we do with our assets and how we do it.

However, at the current stage, while DeFi challenges the existing centralized financial paradigm, CeFi still offers implied stability and old-fashioned trust. Striking a balance between decentralization and centralization, harnessing the strengths of both, is crucial for shaping the future of finance. The next chapter of our civilization will surely be an exciting one, as the financial world navigates through uncharted territory and embraces the possibilities presented by both DeFi and CeFi.